Increased NC County Tax Revenue from Solar Development

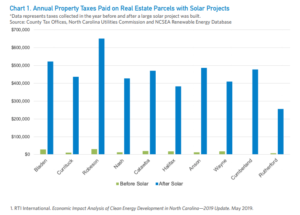

Thanks to the folks at the North Carolina Sustainable Energy Association (NCSEA), there is a great new report that outlines the many ways that investing in clean energy has been a benefit to North Carolina’s economy. NCSEA quantified the tax revenue increase on properties in 50 North Carolina counties identified as having solar developed on them through 2017. The results were astounding: the properties with solar facilities paid almost $10.6 million in property taxes in the year after the facilities were developed compared to only $513,000 in the prior year; a nearly 2,000% increase. That’s 2,000% more tax dollars going back to the county to support vital services such as schools, paramedic services, and infrastructure improvements.

Increased property tax revenue due to solar development is an economic benefit to counties across North Carolina, and we encourage you to read the full report here. While every state and every county is different, this is a data-driven report that shows an incredible boost in tax revenues that is beneficial for officials in all states to see how solar could help increase tax revenues in their county.

If you have property you’d like us to look at for a potential solar farm, anywhere in the US, please reach out!

Thanks again, NCSEA for this report!

Overview:

Over the past decade, North Carolina has been a national leader in solar energy deployment. Most

of the solar energy capacity built in North Carolina has come from utility-scale facilities constructed

and financed by private solar companies, which have created thousands of jobs and have directly

invested a combined $11.6 billion, mostly in economically-challenged (Tier 1 and Tier 2) rural

counties across the state.1

Increased property tax revenue due to solar development is an economic benefit to counties across

North Carolina. Using publicly available property tax data from 50 North Carolina Counties, this

report quantifies the tax revenue increase on properties that NCSEA identified as having solar

developed on them through 2017. Overall, the properties with solar facilities paid almost $10.6

million in property taxes in the year after the facilities were developed compared to only $513

thousand in the prior year; a nearly 2,000 percent increase. Chart 1 highlights the experience of 10

counties, showing the total property taxes collected on parcels where solar facilities were built, in

the year prior to and year after construction. Tax data for the 50 counties included in this study is in

Appendix 1.